Georgia payroll calculator 2023

North Dakotas maximum marginal income tax rate is the 1st highest in the United States ranking. Before beginning OLR its important to view the video below review.

Companies Plan To Give Big Raises In 2023 Amid Inflation Money

Start filing your tax return now.

. Idahos maximum marginal income tax rate is the 1st highest in the United States ranking directly. IT is Income Taxes. Counties and cities can charge an additional local sales tax of up to 125 for a maximum possible combined sales tax of 81.

Final CCPS 2022-23 Test Calendar All Schools. The Cubs traded him after that season to clear payroll to pick up Cole Hamels 20 million option for 2019. AAS 3450 - History of African-Americans in Georgia AAS 3500 - Jazz History AAS 3670 - Social Justice in Sports AAS 3750 - Race and Racism AAS 3810 - History of African-American Music AAS 3880 - African-American Literature.

If you cannot pay off your balance within 120 days setting up a direct debit payment plan online will cost 31 or 107 if set up by phone mail or in-person. You can use our free Georgia income tax calculator to. Groceries and prescription drugs are exempt from the Nevada sales tax.

TAX DAY IS APRIL 17th. If you can pay off your balance within 120 days it wont cost you anything to set up an installment plan. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. What are you waiting for. For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately.

Georgia States core curriculum provides students with a broad background in general education and reflects the special mission of this university as an urban research. The amount of property tax owed depends on the appraised fair market value of the property as determined by the property tax assessor. Its easy to use no lengthy sign-ups and 100 free.

All classifieds - Veux-Veux-Pas free classified ads Website. The Georgia sales tax is 4 so taking advantage of a Georgia sales tax holiday to buy 50000 worth of goods would save you a total of 2000. Like the Federal Income Tax Californias income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Missouris median income is 56517 per year so the median yearly property tax paid by Missouri residents. Once you have filled out the calculator once feel free to make changes to your income state filing status or tax credits to see how different values affect your total income tax bill. Like the Federal Income Tax North Dakotas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Californias maximum marginal income tax rate is the 1st highest in the United States ranking directly. The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. The median property tax in Missouri is 091 of a propertys assesed fair market value as property tax per year.

The Georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2022. Georgia State University requires all students seeking an associates or bachelors degree to satisfactorily complete a basic core of general education subjects. Georgia has five sales tax holidays throughout the year on a.

If you have many products or ads create your own online store e-commerce shop and conveniently group all your classified ads in your shop. Georgia Sales Tax Holidays in 2013 A sales tax holiday is a special time period in which you are allowed to purchase certain items without having to pay the Georgia sales tax. Detailed Georgia state income tax rates and brackets are available on this page.

Fees for IRS installment plans. Serves a fast-growing suburban Atlanta community. Start filing your tax return now.

Georgia State University Clinical Assistant Professor and Director of the Undergraduate Program in Public Health. CCPS Live Viewing List. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11.

Georgia State University Senior Academic Professional and Practice and Career Coordinator. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. The 5th largest school distict in Georgia committed to serving over 50000 diverse students just south of metro Atlanta.

The Payroll Tax also known as the FICA tax. Minimum of four hours of CSC 8930 in which the student completes a project and an additional four hours of graduate-level coursework in computer science at the 6000 level or above exclusive of Foundation Research Thesis Research and Independent Study courses. Iowa State University Research Associate Professor.

That you are an individual paying tax and PRSI under the PAYE system. California collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Oklahoma has a lower state sales tax than 885.

Payroll. It will be updated with 2023 tax year data as soon the data is available from the IRS. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. Clayton County Public Schools Payroll Department is a dedicated team committed to providing on-time and accurate. Includes information about school demographics special events school board meetings and a list of schools.

The 5th largest school distict in Georgia committed to serving over 50000 diverse students just south of metro Atlanta. A degree will be awarded only to a student who meets both the university requirements and the standards of performance academic requirements and residence requirements of their college and of their degree program. Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri.

Nevada has 249 special sales tax jurisdictions with local sales taxes in. North Dakota collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Ready to Register for the 2022-2023 School Year.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Percentage of Home Value Median Property Tax in Dollars A property tax is a municipal tax levied by counties cities or special tax districts on most types of real estate - including homes businesses and parcels of land. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

This time around Smyly could be someone who changes the Cubs sights ahead of free. Georgia State University Catalog System. Florida Hourly Paycheck and Payroll Calculator.

Come and visit our site already thousands of classified ads await you. This calculator is integrated with a W-4 Form Tax withholding feature.

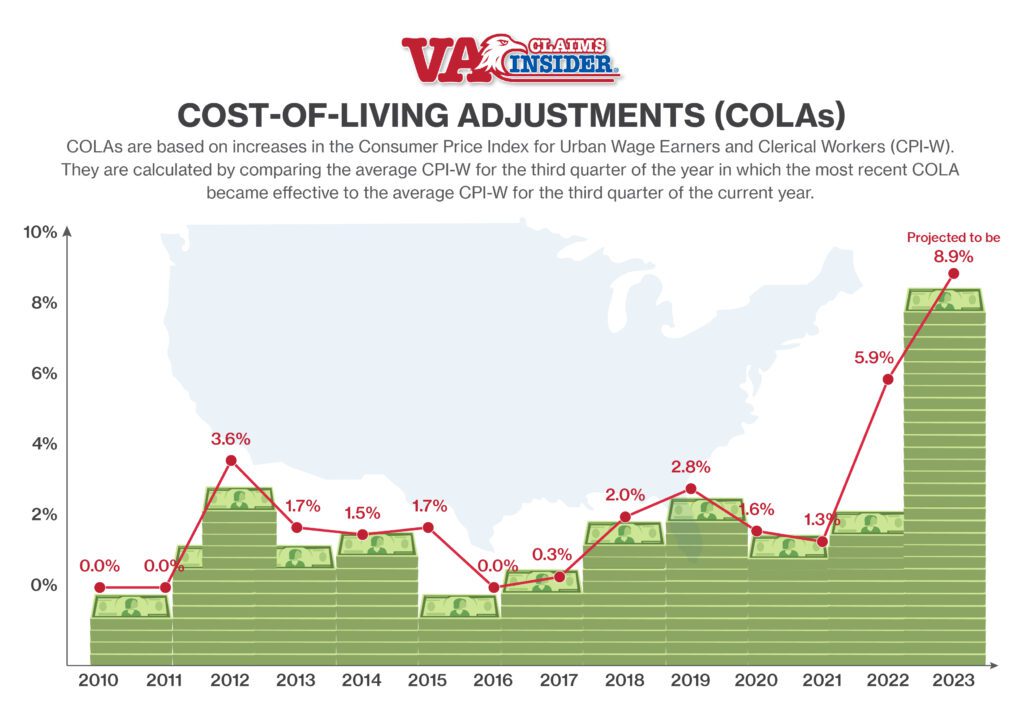

Cola Prediction What Is The Expected Ss Cola For 2023 Marca

2023 Hyundai Palisade Choosing The Right Trim Autotrader

2023 College Football Championship Odds Track Ncaaf Favorites

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

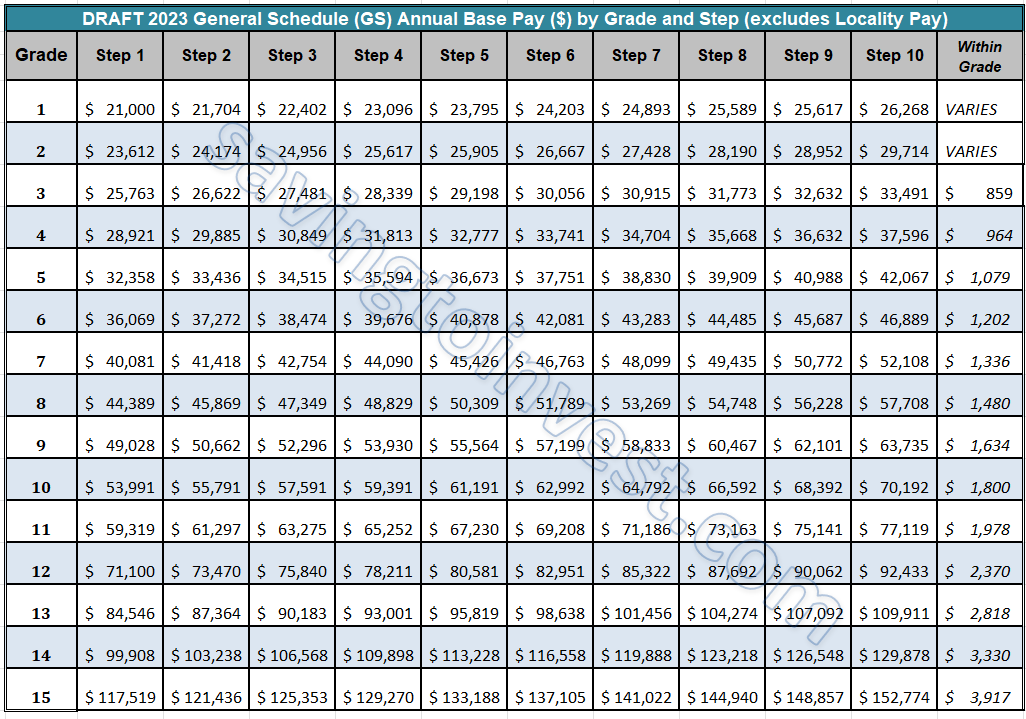

2023 Federal Pay Raise Update House Committee Endorses 4 6

Federal Register Medicare Program Prospective Payment System And Consolidated Billing For Skilled Nursing Facilities Updates To The Quality Reporting Program And Value Based Purchasing Program For Federal Fiscal Year 2023 Changes To

Federal Register Medicare Program Calendar Year Cy 2023 Home Health Prospective Payment System Rate Update Home Health Quality Reporting Program Requirements Home Health Value Based Purchasing Expanded Model Requirements And Home Infusion

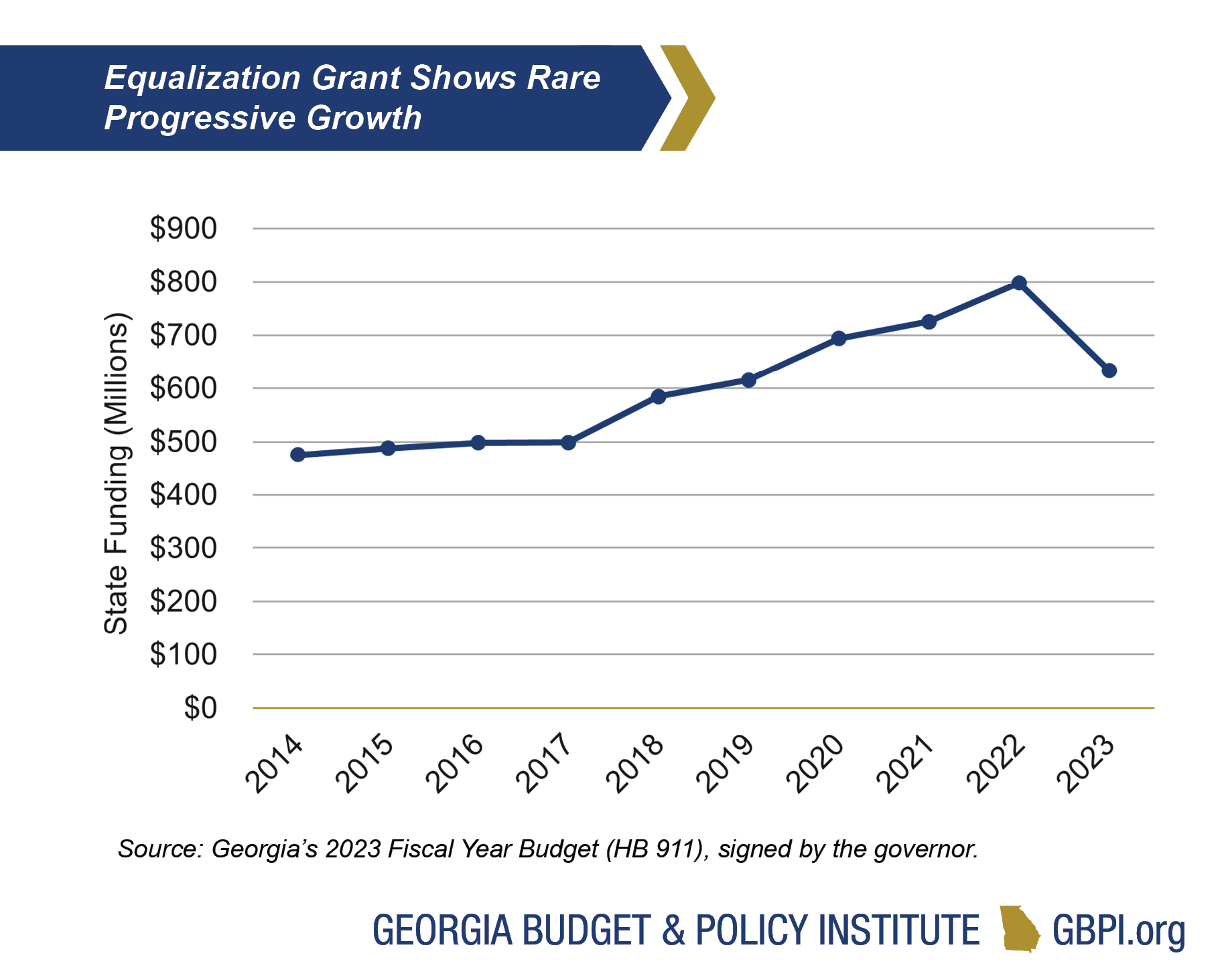

Georgia Education Budget Primer For State Fiscal Year 2023 Georgia Budget And Policy Institute

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Moaa Here S Why Your Medicare Part B Costs May Drop In 2023

Georgia State University Holidays 2020 Georgia State University Georgia State State University

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Eligibility Income Guidelines Georgia Department Of Public Health

When Is Social Security Increase For 2023 Announced Cola May Be Most In 40 Years Oregonlive Com

Calculator And Estimator For 2023 Returns W 4 During 2022

Will There Be A 2023 Cola Increase Massive 8 9 Social Security Increase Could Be Coming Va Claims Insider

B9efghe6screwm